M&A for the new

generation of founders

M&A for the

new generation

of founders

We help sellers navigate their next strategic move

with the right blend of expertise, technology, and personalized support.

We help sellers navigate their next strategic move with the right blend of expertise, technology, and personalized support.

OUR GOAL

OUR GOAL

OUR GOAL

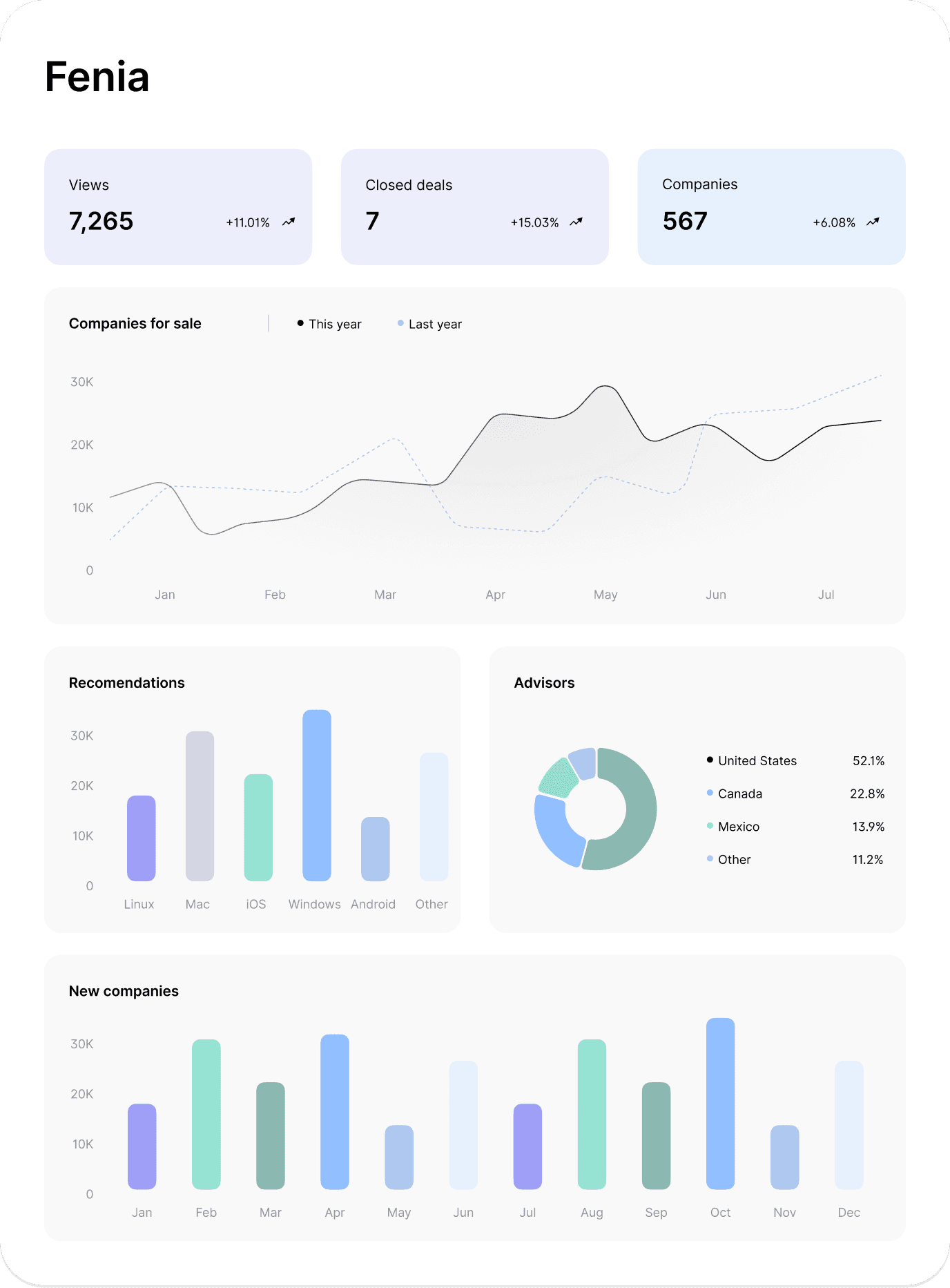

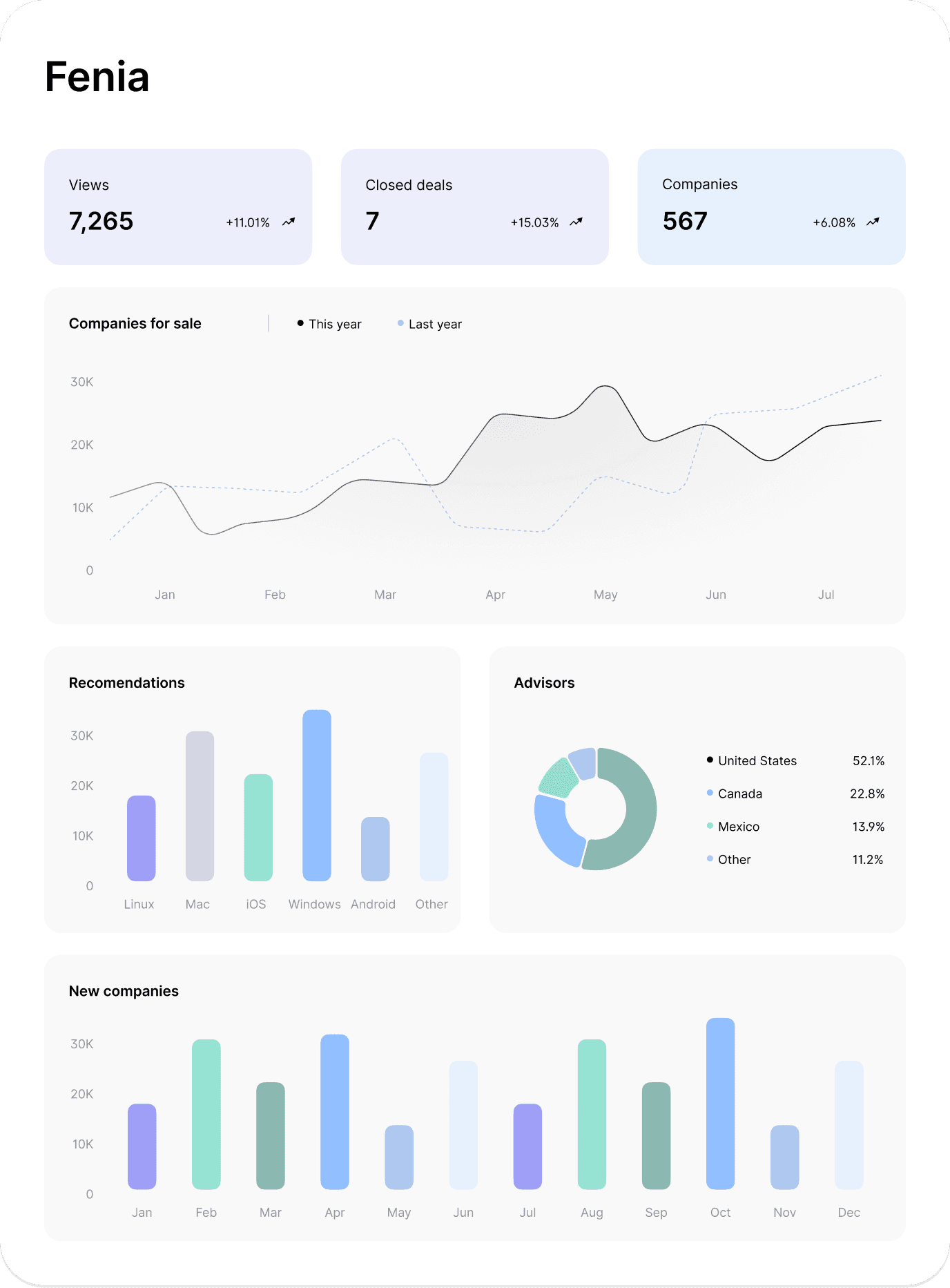

Meet Fenia:

The First Value-Focused M&A Boutique

Meet Fenia:

The First Value-Focused M&A Boutique

We believe great deals come from understanding your goals, not rushing the process. Your purpose stays intact, backed by smart negotiation strategies that deliver real value.

We believe great deals come from understanding your goals, not rushing the process. Your purpose stays intact, backed by smart negotiation strategies that deliver real value.

Take the First Step

Take the First Step

Take the First Step

What are

you looking for?

What are

you looking for?

What are

you looking for?

You don’t have to figure it all out alone.

Let’s take that first step together.

Selling equity is a way to unlock strategic opportunities – scaling, financial security, and the freedom to focus on what truly matters: growing your vision.

You don’t have to figure it all out alone. Let’s take that first step together.

Selling equity is a way to unlock strategic opportunities – scaling, financial security, and the freedom to focus on what truly matters: growing your vision.

Do you want to scale and grow your business faster?

Selling equity unlocks new resources, expertise, and networks to accelerate your growth and enter new markets seamlessly.

Are you looking to secure financial stability?

By selling equity, you gain access to liquidity that ensures your financial future while still having the option to remain involved in your company.

Are you afraid to sell and loose your company culture?

Your team shapes your culture through shared values and growth. Therefore, partnering with investors who align with your values is a way to expand your culture.

Do some of your shareholders want to exit?

Selling equity offers a structured path for shareholders seeking an exit while ensuring business continuity and stability.

Are you planning your next chapter?

Whether it’s starting a new venture, launching a new product or gaining personal freedom, selling equity gives you the flexibility to shape what comes next.

Do you want to scale and grow your business faster?

Selling equity unlocks new resources, expertise, and networks to accelerate your growth and enter new markets seamlessly.

Are you looking to secure financial stability?

By selling equity, you gain access to liquidity that ensures your financial future while still having the option to remain involved in your company.

Are you afraid to sell and loose your company culture?

Your team shapes your culture through shared values and growth. Therefore, partnering with investors who align with your values is a way to expand your culture.

Do some of your shareholders want to exit?

Selling equity offers a structured path for shareholders seeking an exit while ensuring business continuity and stability.

Are you planning your next chapter?

Whether it’s starting a new venture, launching a new product or gaining personal freedom, selling equity gives you the flexibility to shape what comes next.

Do you want to scale and grow your business faster?

Selling equity unlocks new resources, expertise, and networks to accelerate your growth and enter new markets seamlessly.

Are you looking to secure financial stability?

By selling equity, you gain access to liquidity that ensures your financial future while still having the option to remain involved in your company.

Are you afraid to sell and loose your company culture?

Your team shapes your culture through shared values and growth. Therefore, partnering with investors who align with your values is a way to expand your culture.

Do some of your shareholders want to exit?

Selling equity offers a structured path for shareholders seeking an exit while ensuring business continuity and stability.

Are you planning your next chapter?

Whether it’s starting a new venture, launching a new product or gaining personal freedom, selling equity gives you the flexibility to shape what comes next.

Do you want to scale and grow your business faster?

Selling equity unlocks new resources, expertise, and networks to accelerate your growth and enter new markets seamlessly.

Are you looking to secure financial stability?

By selling equity, you gain access to liquidity that ensures your financial future while still having the option to remain involved in your company.

Are you afraid to sell and loose your company culture?

Your team shapes your culture through shared values and growth. Therefore, partnering with investors who align with your values is a way to expand your culture.

Do some of your shareholders want to exit?

Selling equity offers a structured path for shareholders seeking an exit while ensuring business continuity and stability.

Are you planning your next chapter?

Whether it’s starting a new venture, launching a new product or gaining personal freedom, selling equity gives you the flexibility to shape what comes next.

What should you expect

What should you expect

Let’s Be Honest

Let’s Be Honest

Selling your company takes time and effort, and it can feel overwhelming. But with the right guidance, it turns into a journey worth taking. The journey is…

Selling your company can feel overwhelming—until the right guidance turns it into a rewarding journey. Here's what that journey looks like:

Selling your company takes time and effort, and it can feel overwhelming. But with the right guidance, it turns into a journey worth taking. The journey is:

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 02

Market Mapping & Positioning

We identify both strategic and financial buyers, assessing their compatibility with your long-term vision. We provide market intelligence and industry benchmarks to enhance negotiation leverage and prepare the ground for impactful conversations.

Phase 03

Investment Materials & Valuation

We design high-level, dynamic materials to present your company: teaser, confidential presentation, and an in-depth information pack tailored to different buyer profiles. We also run financial planning sessions and prepare a robust valuation analysis to anticipate key questions and reinforce your strategic positioning.

Phase 04

Buyer Engagement & Negotiation

We contact selected buyers, share materials under NDA, and coordinate key meetings. We support your team throughout negotiations, helping you understand not just the price, but the strategic fit — and what each offer really means for the future of your company.

Phase 05

Final Contract Negotiation & Closing

We support you throughout the buyer’s due diligence process — led and funded by the buyer — helping you stay prepared and responsive. We work closely with your external lawyer during contract negotiation, staying involved until signing to ensure the process is efficient, risks are managed, and terms reflect your priorities.

Phase 06

ENSURING LONG-TERM SUCCESS

Our work doesn’t end at closing. We assist with post-integration strategies to align teams, processes, and systems, ensuring a smooth transition and preserving the value of the deal for long-term success.

Phase 01

Phase 02

Phase 03

Phase 04

Phase 05

Phase 06

Phase 1

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

WHY FENIA?

WHY FENIA?

What should you expect

value-focused deal execution

value-focused deal execution

Let’s Be Honest

SMART TOOL STACK

First AI driven M&A boutique, we combine human expertise with a smart stack of tools (AI, Notion, transcription automation, dashboards) to deliver faster analysis and more relevant conversations.

DESIGN TO GET PAID

We design achivable deal terms — so you’re not just signing a great deal, but actually receiving its full value.

Smart Earn-outs conditions can actually work in your favor — and completely change your post-integration experience.

STRATEGY OVER COMISSION

We ensure the process is shaped around your goals, not our incentives. We follow a milestone-based model that adapts to your timing and priorities.

When alignment comes first, the right deal follows.

THE VALUE

Calculate your

company value now

Fast, free, and 100% private

calculated with market data you can trust!

THE VALUE

Calculate your

company value now

Fast, free, and 100% private calculated with market data you can trust!

THE VALUE

Calculate your

company value now

Fast, free, and 100% private calculated with market data you can trust!

THE VALUE

Calculate your

company value now

Fast, free, and 100% private

calculated with market data you can trust!

HEAR IT FROM OUR CEO

M&A for the new

generation of founders

Founders often face challenges balancing growth and their company’s core values. We help them redefine their vision, align their team and financial strategy, and secure the right partners to drive their next chapter.

Alejandra Fernández Cobo.

HEAR IT FROM OUR CEO

M&A for the new

generation of founders

Founders often face challenges balancing growth and their company’s core values. We help them redefine their vision, align their team and financial strategy, and secure the right partners to drive their next chapter.

Alejandra Fernández Cobo.

HEAR IT FROM OUR CEO

M&A for the new

generation of founders

Founders often face challenges balancing growth and their company’s core values. We help them redefine their vision, align their team and financial strategy, and secure the right partners to drive their next chapter.

Alejandra Fernández Cobo.

HEAR IT FROM OUR CEO

M&A for the new

generation of founders

Founders often face challenges balancing growth and their company’s core values. We help them redefine their vision, align their team and financial strategy, and secure the right partners to drive their next chapter.

Alejandra Fernández Cobo.

Selling your company takes time and effort, and it can feel overwhelming. But with the right guidance, it turns into a journey worth taking. The journey is:

Phase 01

Phase 02

Phase 03

Phase 04

Phase 05

Phase 06

Phase 1

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.

Phase 01

Phase 02

Phase 03

Phase 04

Phase 05

Phase 06

Phase 1

Initial Assessment

Introductory meeting to deeply understand the management team’s expectations, transaction objectives, and estimated market valuation range. Together, we define the ideal buyer profile and align the go-to-market strategy with shareholders' interests.